Basic

features.

StockMarketMirror is advanced, innovative

and easy to use software for advanced technical analysis of stock

markets with stock market timing and charting of individual stocks and

overall stock market, supporting profitable swing trading, portfolio

picking and optimal management of trading risk for individual and

institutional investors. It can be used for automatic generating of

reliable trading signals and profitable portfolio picking for NASDAQ,

NYSE and major stock markets of the world.

StockMarketMirror software is capable of:

- Automatic download of free EOD stock history from Yahoo! for major

stock markets of America, Asia, Australia and Europe. User can create

new dedicated stock lists (data sources) for monitoring various

industry sectors. You can also use stock history, maintained in a

local folder of your computer in CSV data format.

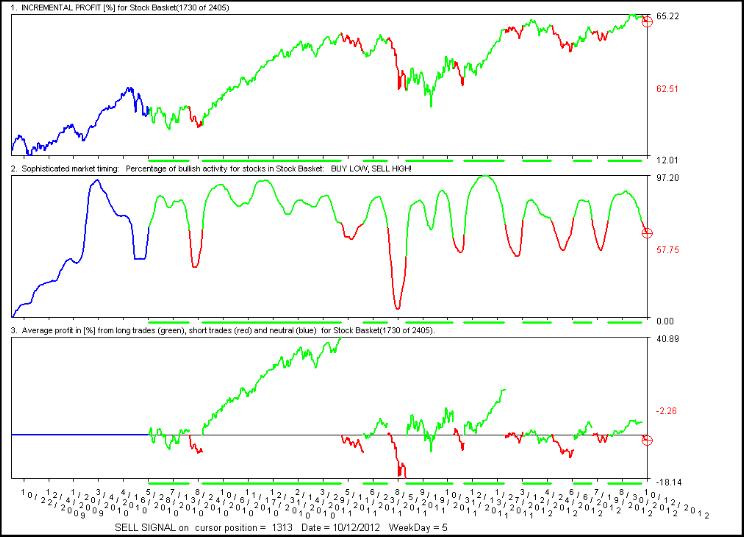

- Sophisticated stock market timing calculations using long-term

swings scenario as well as short-term swings scenario. User can also

define his own market timing scenario by selecting and saving user

defined parameters of timing. Market timing analysis is summarized

into detailed output report in the hypertext format and CSV files.

- Single click feature, enabling stock history update and market

timing calculations with a single mouse click. You can also run stock

history update and market timing calculations over night, using Task

Scheduler.

- Precise timing of various ETFs via lists of their components,

which is especially suitable to keep costs of trading as low as

possible while having the benefit of reliable trading signals.

- Mild form of market timing, visualizing deviations of market trend

from the straight line, which makes buying low and selling high

principle easy to follow.

- Recommendations for portfolio candidates – they are available in

the output report for user convenience.

- Sophisticated stock screening is also supported, which is a

heuristic approach to selection of a profitable portfolio or pool of

stock symbols for individual trading.

- Fundamental analysis is made easy by automatic downloading of

basic fundamental information from Yahoo! or other Internet sources.

- Running on Windows 7, Vista, XP, 2000, NT, 9x.

Download the latest market timing

report >>>

Software download

>>>

Basic principles of market timing

calculations.

As far as principles of market timing calculations are concerned,

there are no deep mysteries about them. They can be briefly described as

two step process. The first step is to calculate a curve of bullish

market activity from the price curves of stock symbols available in the

selected stock list. Mathematical algorithm based on regression analysis

is used for that purpose. Resulting curve of bullish market activity is

quite smooth with distinct tops and bottoms, which makes buy low sell

high principle easy to follow even on the basis of visual inspection.

The second step is to determine the entry and exit points on the curve

of bullish market activity, which approximately obey buy low, sell high

principle.

The dynamics of stock market changes has a wave character with the

distinct short-term swings and long- term swings. Therefore two

corresponding scenarios were prepared for market timing calculations to

be selected from, on the basis of user preferences. Every scenario is

determined with its own market timing parameters. User can also define

its own market timing parameters and thus creating its own market timing

scenario.

The scenario for catching long-term

swings.

Values RegressVectors=9, RegressPoints=350 are best suitable for

catching long-term market swings at the current US stock market. Some

patience is required, because the timing calculations are very time

consuming, taking about half an hour to produce results on standard

computer if the default setting is used.

Download the latest market timing

report >>>

Software download

>>>

The scenario for catching short-term

swings.

Values RegressVectors=12, RegressPoints=50 are best suitable for

catching short-term market swings.

User is also allowed to define,

test, save and load his or her favorite values of timing parameters. The

most users will find it useful to concentrate on trading long-term

market swings, because they give excellent profitability with small

number of trades, low level of risk and can also be done as a leisure

time activity. That is why all data sources delivered in the software

installation package are predefined for catching long-term market

swings. Trading of short-term market swings is more suitable to

professional traders then amateurs.

Download the latest market timing

report >>>

Software download >>>